Welcome to this article on Response To Irs Letter Sample. Below, you will find examples of Response To Irs Letter Sample that you can use as a guide and modify as needed.

Explanation of Response To Irs Letter Sample

When you receive a letter from the IRS, it can be a stressful and overwhelming experience. It is important to respond promptly and appropriately to address any issues or concerns raised in the letter. Here are some common pain points for individuals when responding to an IRS letter:

- Understanding the reason for the letter

- Gathering necessary documentation

- Formulating a clear and concise response

- Ensuring compliance with IRS regulations

Example of Response To Irs Letter Sample

Dear [Recipient’s Name],

I am writing in response to the letter I received from the IRS dated [Date], regarding [Brief description of the issue raised in the letter]. After reviewing the letter and the information provided, I would like to address the concerns raised as follows:

Firstly, I would like to clarify that [Provide explanation or additional information]. This was an oversight on my part, and I take full responsibility for the error. I have taken the necessary steps to rectify the issue and ensure that it does not happen again in the future.

Secondly, I have enclosed the requested documentation, including [List of documents provided]. I hope that this information will assist in resolving the matter promptly and to your satisfaction.

In conclusion, I appreciate the opportunity to address the concerns raised in the letter and thank you for your attention to this matter. Should you require any further information or have any questions, please do not hesitate to contact me at [Your contact information].

Sincerely,

[Your Name]

Response To Irs Letter Sample

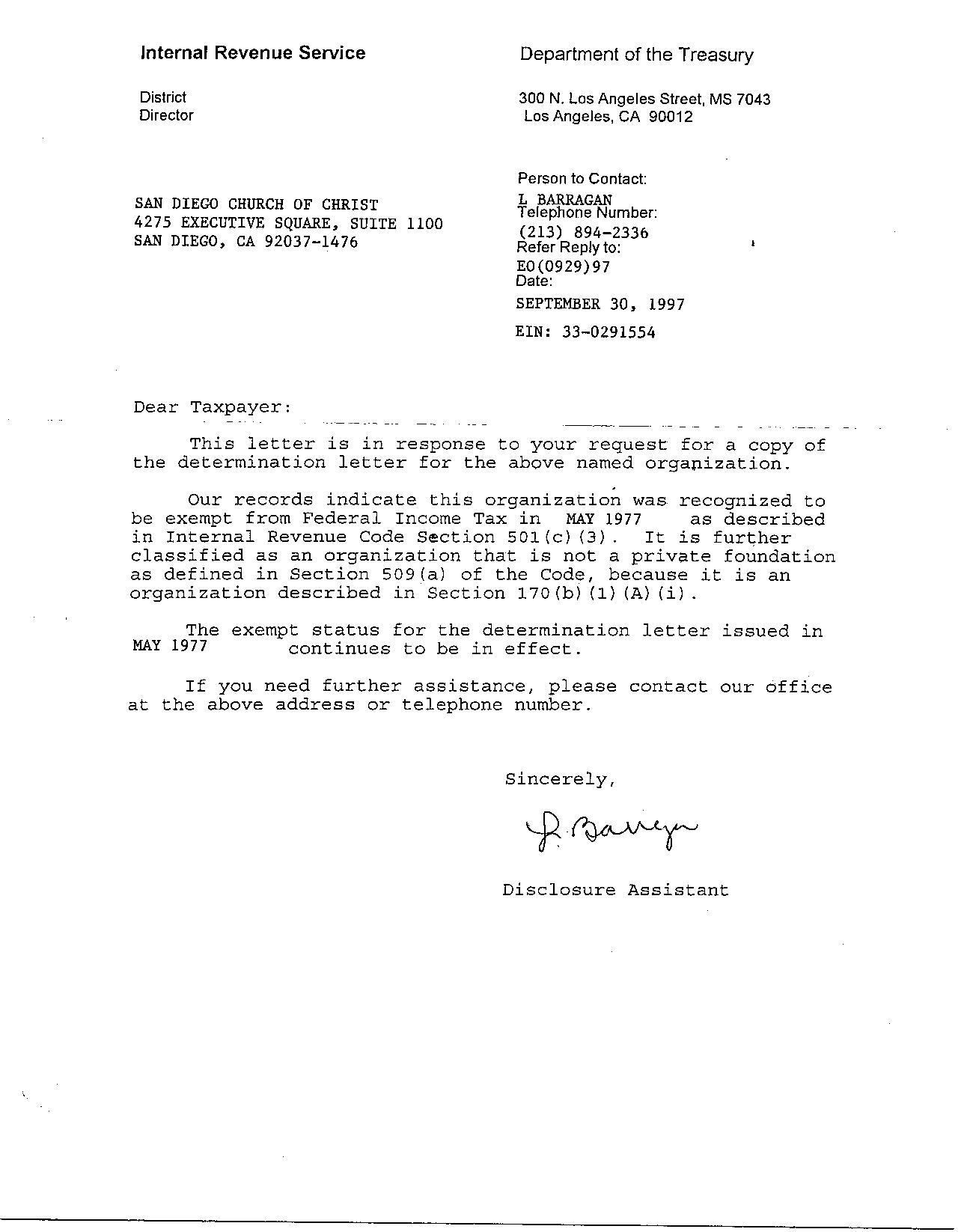

IRS Response Letter Template | Federal Government Of The United States

IRS Audit Letter CP134B – Sample 1

IRS Letter 2202 – Sample 1

Irs Response Letter Template – 11+ Professional Templates Ideas

Example Letters to Irs on Cp504 Form – Fill Out and Sign Printable PDF

Letter To Irs – Free Printable Documents