Are you in need of an Irs Penalty Abatement Request Letter Sample? Look no further! Below, you will find examples of sample letters that you can use as a template for crafting your own letter. Feel free to modify these templates to suit your specific needs and circumstances.

Understanding the Need for an Irs Penalty Abatement Request Letter Sample

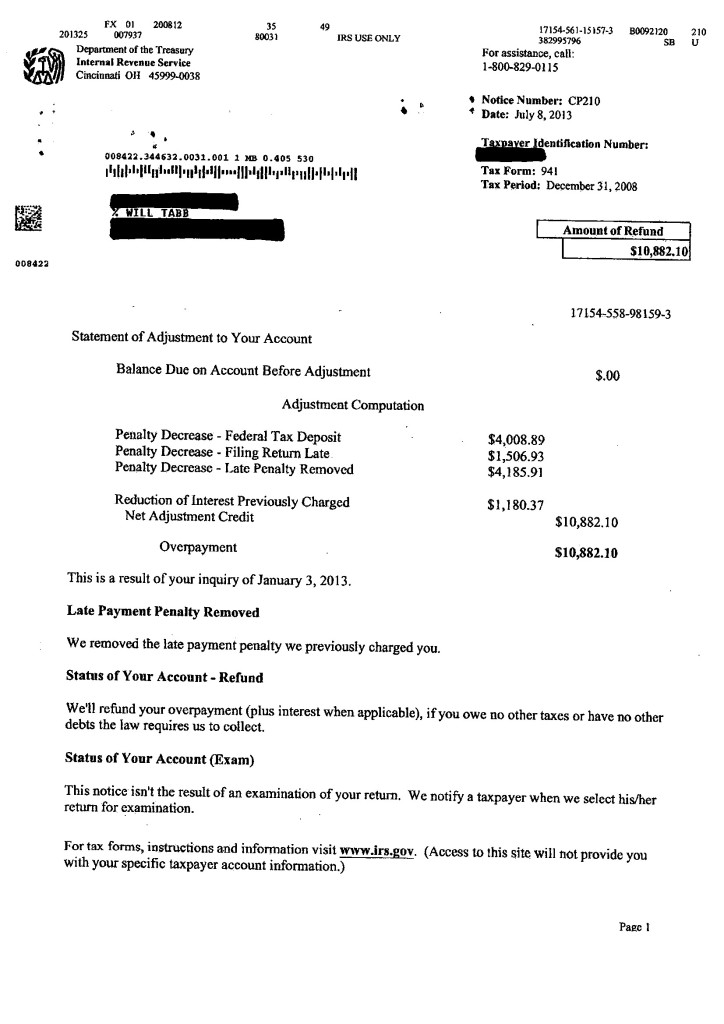

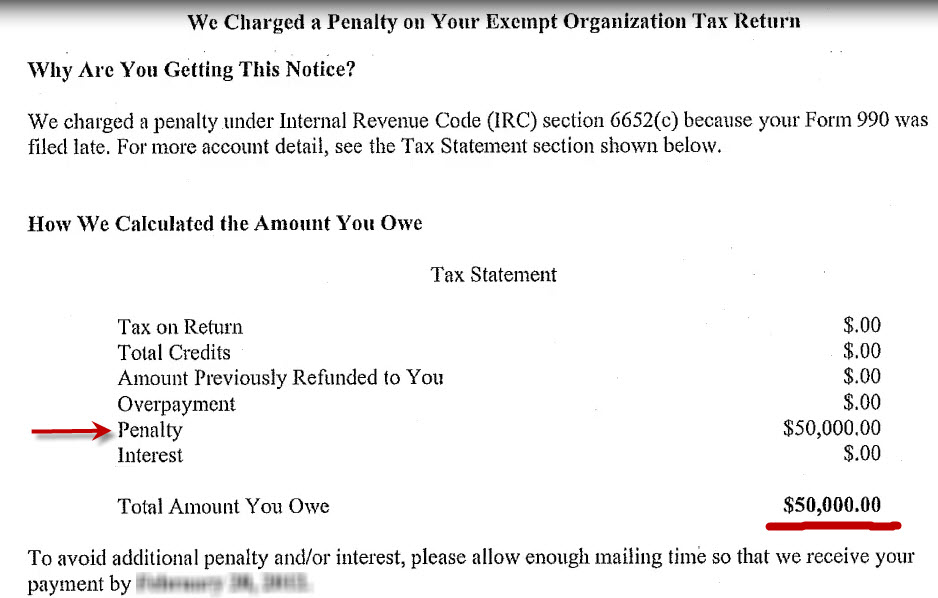

Receiving a penalty from the IRS can be a stressful and overwhelming experience. Whether it was due to a simple mistake or unforeseen circumstances, dealing with the consequences of an IRS penalty can be daunting. However, there is a way to potentially reduce or eliminate these penalties through an abatement request. By submitting a well-crafted Irs Penalty Abatement Request Letter, you can explain your situation to the IRS and request leniency in the form of penalty relief.

Here are some common reasons why individuals or businesses may need to submit an Irs Penalty Abatement Request Letter:

- Incorrect information provided on tax returns

- Failure to file tax returns on time

- Late payment of taxes

- Financial hardship or extenuating circumstances

Example of Irs Penalty Abatement Request Letter Sample

Dear [Recipient’s Name],

I am writing to request an abatement of penalties assessed on my recent tax return for the tax year [insert year]. I understand that the penalties were incurred due to [briefly explain the reason for the penalties, such as a late payment or filing].

I would like to request penalty relief based on the following reasons:

- Unforeseen circumstances that led to the delay in payment/filing

- Previous compliance with tax laws and timely filing/payment history

- Evidence of financial hardship or other mitigating factors

I have taken steps to rectify the situation and ensure that similar issues do not arise in the future. I am willing to work with the IRS to come to a resolution that is fair and equitable for both parties.

Thank you for your time and attention to this matter. I appreciate your consideration of my request for penalty abatement.

Sincerely,

[Your Name]

Irs Penalty Abatement Request Letter Sample

Letter For Abatement of Penalty – Word

Reasonable Cause Sample Letter To Irs To Waive Penalty – Fill Online

Penalty Abatement Sample Letter To Irs To Waive Penalty Cover Letters

IRS Letter 854C – IRS Denied Your Request for Abatement/Penalty

How to remove an IRS form 990 late filing penalty. Write an Effective

IRS Letter 693 – Reply to Request for Reconsideration of Assessment | H