Are you in need of an Irs Offer In Compromise Letter Sample? Look no further! Below, you will find examples of offer in compromise letters that you can use as a template for your own unique situation. Feel free to modify these samples to suit your specific needs.

Understanding the Need for Irs Offer In Compromise Letter Sample

When dealing with the IRS, it can be challenging to navigate the complex processes and requirements. One critical document that taxpayers may need to prepare is an offer in compromise letter. This letter is a formal request to the IRS to settle tax debts for less than the full amount owed.

Having a well-crafted offer in compromise letter can significantly increase your chances of success in negotiating with the IRS. It is essential to clearly articulate your reasons for requesting a compromise and provide all necessary supporting documentation to bolster your case.

Example of Irs Offer In Compromise Letter Sample

Dear [Recipient’s Name],

I am writing to formally request an offer in compromise for my outstanding tax debt. Due to unforeseen circumstances, I have experienced financial hardship that has made it impossible for me to pay the full amount owed.

I have enclosed all relevant financial documents to support my request, including bank statements, pay stubs, and a detailed breakdown of my monthly expenses. I believe that my current financial situation warrants a compromise on the amount owed.

I am committed to resolving this matter promptly and am willing to work with the IRS to come to a mutually agreeable solution. I appreciate your prompt attention to this request and look forward to a favorable resolution.

Sincerely,

[Your Name]

Irs Offer In Compromise Letter Sample

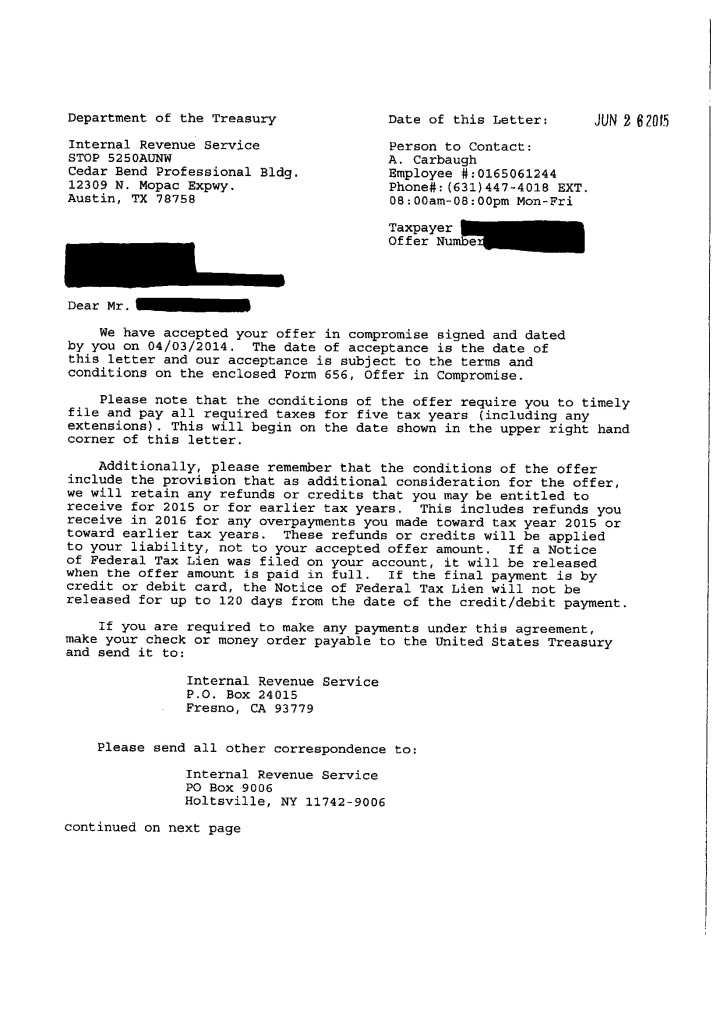

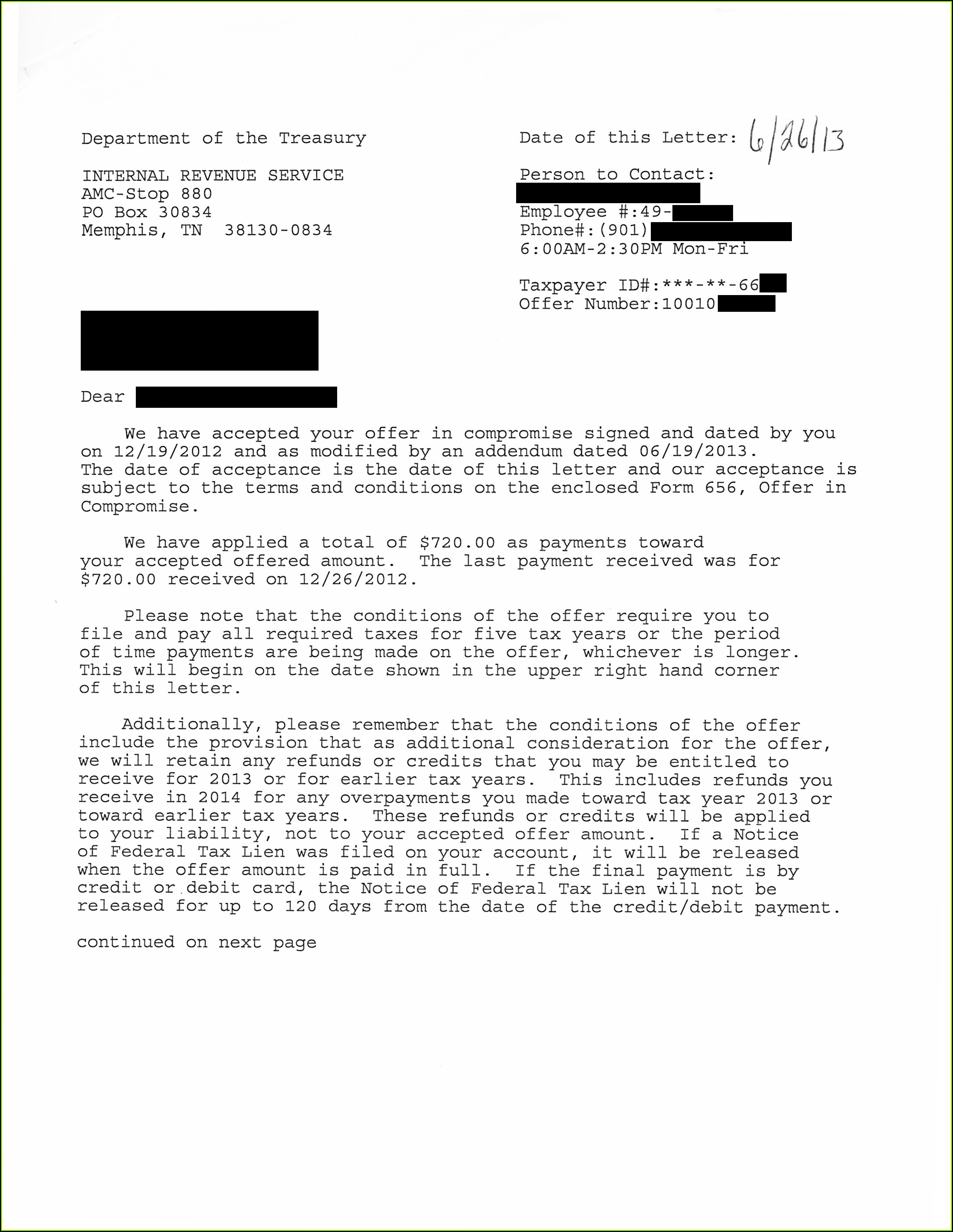

Offer in Compromise – Tabb Financial Services

Offer In Compromise – Tax Debt Advisors

compromise letter sample Doc Template | pdfFiller

Irs Offer In Compromise Forms – Form : Resume Examples #1ZV8nkE93X

Offer In Compromise: Offer In Compromise Letter Example

IRS Response Letter Template | Federal Government Of The United States