Are you looking for examples of Irs First Time Abatement Letter Sample? Look no further! Below, you will find a sample letter that you can use as a template for your own communication with the IRS. Feel free to modify it as needed to best suit your situation.

Understanding the Need for Irs First Time Abatement Letter Sample

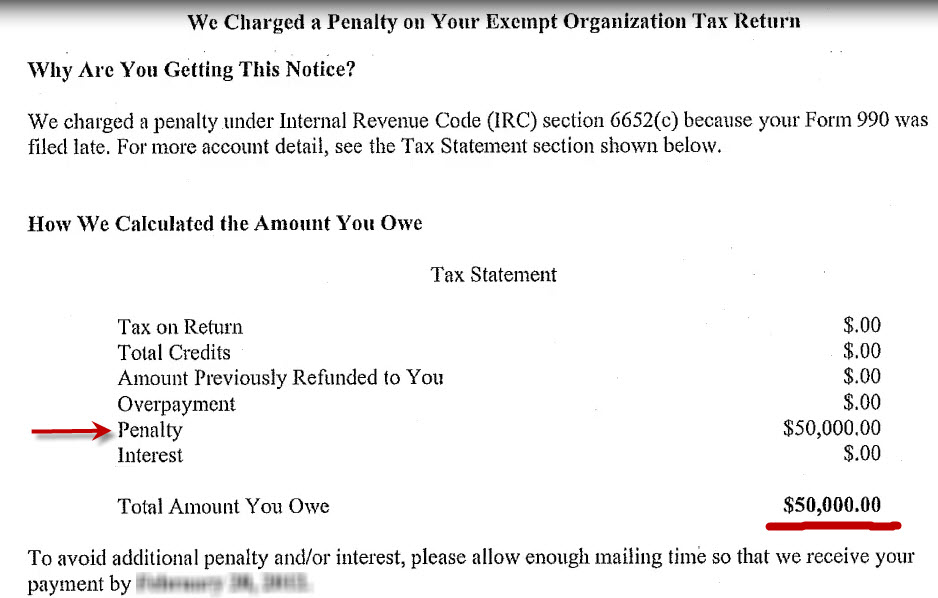

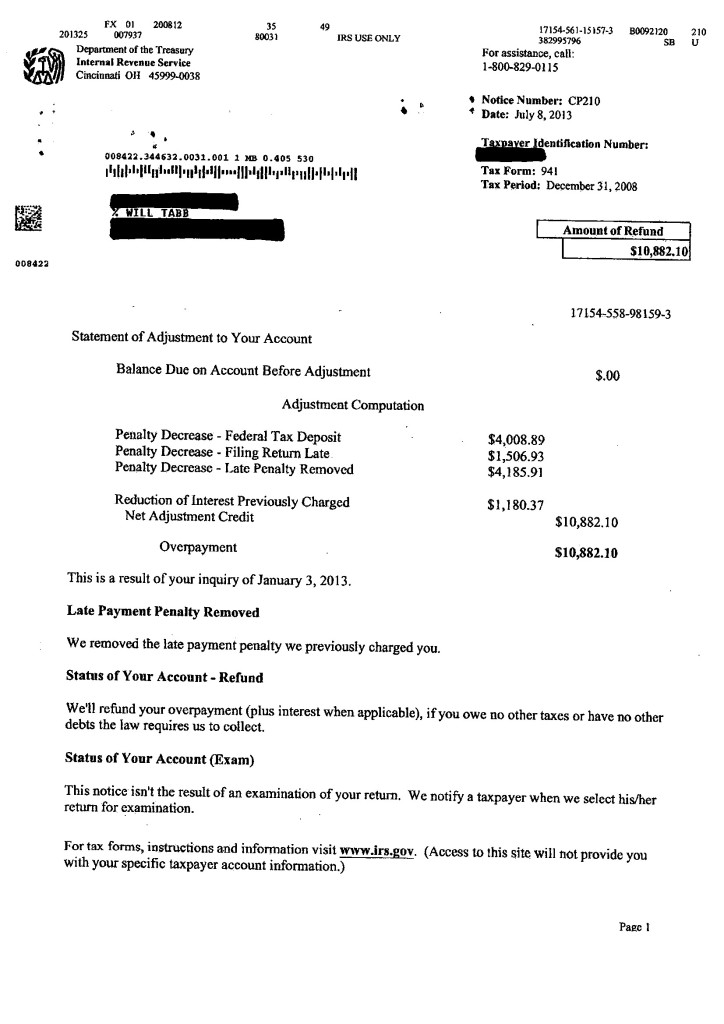

When dealing with the IRS, it is not uncommon to encounter situations where penalties or interest have been assessed on past tax liabilities. In some cases, taxpayers may be eligible for first-time abatement (FTA), which allows for the waiver of these penalties for the first time. However, in order to request FTA, taxpayers are required to submit a formal request in the form of a letter to the IRS.

- Provide a brief background on the issue that led to the penalties or interest.

- Explain why you believe you qualify for first-time abatement.

- Request that the penalties or interest be waived under the FTA policy.

Example of Irs First Time Abatement Letter Sample

Dear [Recipient’s Name],

I am writing to request first-time abatement (FTA) for the penalties that were imposed on my tax liabilities for the tax year [insert year]. I believe that I qualify for FTA based on my compliance history and the circumstances surrounding the issue that led to these penalties.

As a law-abiding taxpayer who has always strived to meet my tax obligations, I was surprised to learn about the penalties that were assessed on my account. Upon reviewing the details of the situation, I realized that the issue was a result of [briefly explain the circumstances that led to the penalties].

Given my clean compliance record and the fact that this is the first time I have encountered such penalties, I kindly request that the penalties be waived under the first-time abatement policy. I am committed to ensuring that such issues do not arise again in the future and will take necessary steps to prevent them.

Thank you for considering my request. I appreciate your attention to this matter and look forward to a favorable resolution. Please feel free to contact me if you require any additional information or clarification.

Sincerely,

[Your Name]

Irs First Time Abatement Letter Sample

letter for abatement of penalty.word.docx

IRS Notice CP215 – Notice of Penalty Charge | H&R Block

Form 843: Claim for Refund and Request for Abatement: How to File

:max_bytes(150000):strip_icc()/843-ClaimforRefundandRequestforAbatement-f50c59124198404abb88bc50a5f81fc4.png)

How to remove an IRS form 990 late filing penalty. Write an Effective

Penalty Abatement Sample Letter To Irs To Waive Penalty Cover Letters

Reasonable Cause Sample Letter To Irs To Waive Penalty – Fill Online