Welcome to our article discussing Irs Audit Reconsideration Letter Sample. Below, you will find examples of letters that can be used as a template for crafting your own letter to the IRS. Feel free to modify these samples to fit your specific situation and needs.

The Purpose of Irs Audit Reconsideration Letter Sample

When facing an IRS audit, it is important to respond promptly and professionally. Writing a well-crafted reconsideration letter can help you address any issues or discrepancies identified during the audit process. The letter allows you to present your case and provide additional information that may impact the audit outcome.

- Clarify any misunderstandings or errors in the audit report

- Provide additional documentation or evidence to support your position

- Request a review of the audit findings based on new information

Example of Irs Audit Reconsideration Letter Sample:

Dear [Recipient’s Name],

I am writing to request a reconsideration of the audit findings for [tax year or period]. I believe there may have been a misunderstanding or error in the audit report, and I would like to provide additional information for your review.

During the audit process, it came to my attention that certain expenses were not properly documented. I have since located the missing receipts and invoices that support these deductions. I have attached copies of these documents for your reference.

Furthermore, I have discovered an error in the calculation of my taxable income for the year in question. After reviewing my financial records, I believe there was an oversight that led to an incorrect assessment. I have included a revised income statement for your review.

I respectfully request that you reconsider the audit findings in light of this new information. I am confident that once you have reviewed the additional documentation, you will find that the original assessment was inaccurate.

Sincerely,

John Doe

Irs Audit Reconsideration Letter Sample

IRS Audit Reconsideration Letter

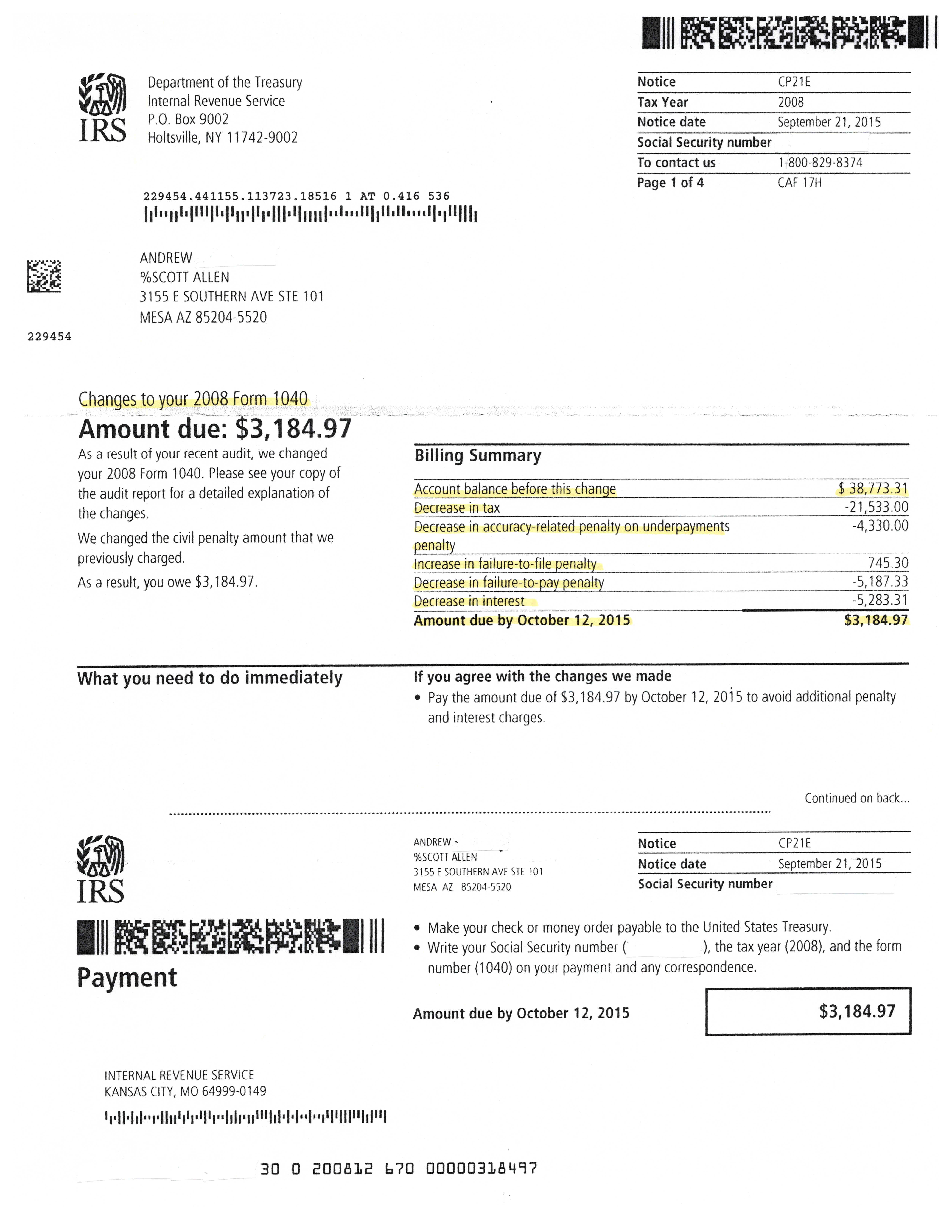

Successful IRS Audit Reconsideration in Phoenix Arizona – Tax Debt

How To Write A Letter Of Reconsideration To Irs ~ Alice Writing

IRS Audit Letter 2205-B – Sample 1

Irs Audit Reconsideration Letter Sample