Are you in need of an Irs 501c3 Determination Letter Sample? Look no further! Within this article, you will find examples of Irs 501c3 Determination Letter Samples that you can use and modify as needed for your specific situation.

Understanding the Need for Irs 501c3 Determination Letter Sample

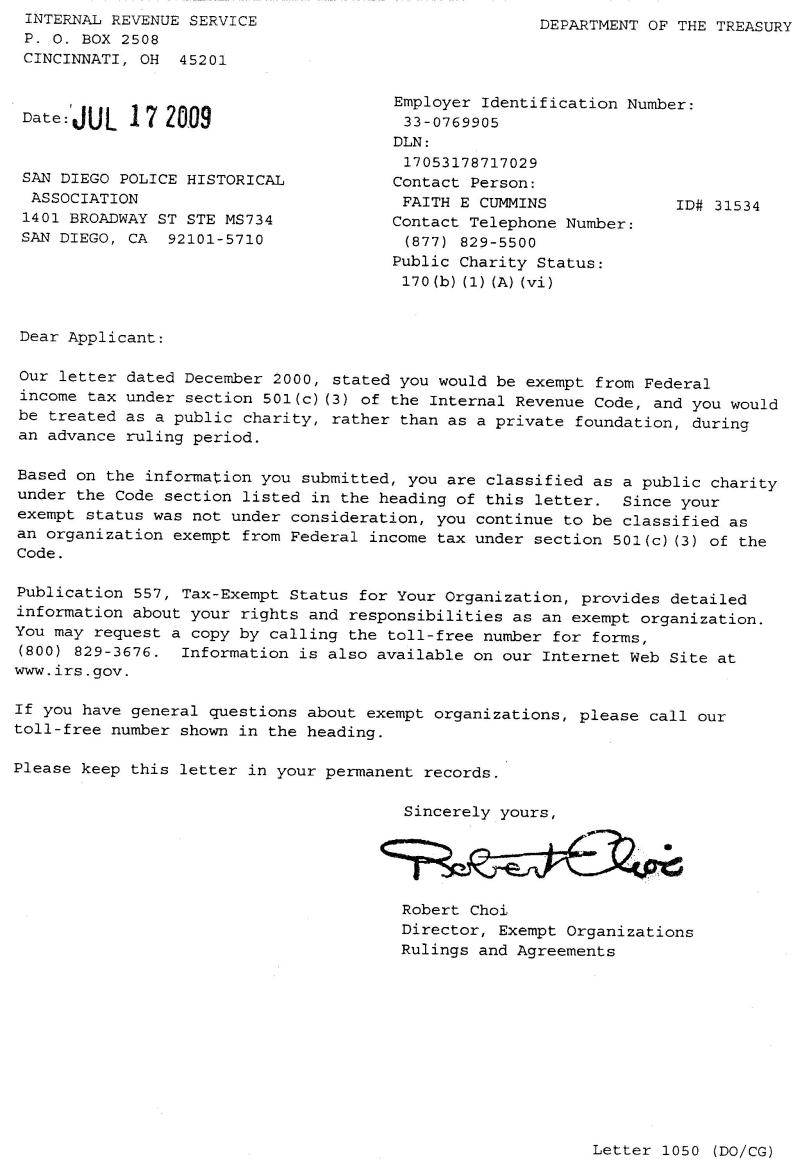

When applying for tax-exempt status under section 501(c)(3) of the Internal Revenue Code, organizations are required to submit a determination letter from the IRS. This letter serves as official recognition of the organization’s tax-exempt status and is crucial for receiving donations and grants. However, crafting a compelling determination letter can be a challenging task for many organizations.

- Ensuring that the letter includes all necessary information

- Conveying the organization’s mission and activities effectively

- Persuading the IRS of the organization’s eligibility for tax-exempt status

Example of Irs 501c3 Determination Letter Sample

Dear [Recipient’s Name],

I am writing on behalf of [Organization Name], a non-profit organization dedicated to [mission or purpose of the organization]. Our organization has been serving the community since [year of establishment] and has made significant contributions in the areas of [list of activities or programs].

We believe that our work aligns with the requirements for tax-exempt status under section 501(c)(3) of the Internal Revenue Code. Our primary goal is to [brief description of primary goal] and we rely on the support of donors and grants to continue our important work.

Enclosed, please find our application for tax-exempt status along with supporting documentation. We are confident that our organization meets all the criteria outlined by the IRS and respectfully request consideration for 501(c)(3) status.

Thank you for your time and attention to this matter. Should you require any additional information, please do not hesitate to contact me at [contact information].

Sincerely,

[Your Name]

Irs 501c3 Determination Letter Sample

501(c)3 determination letter

501 (c) 3 IRS Determination Letter – New Hope Pastoral & Mercy Ministries

501c3 Determination Letter | Hawaii Emergency Radio Operators | HERO

Irs 501c3 Determination Letter Sle – Infoupdate.org

2nd request for IRS Determination Letter for 501(c)(3) – TechSoup Forums

501c3 Letter Sample | amulette