Are you in need of an Insurance No Loss Letter Sample? Look no further! Below, you will find an example of an Insurance No Loss Letter that you can use as a template. Feel free to modify it to suit your specific needs.

Understanding the Purpose of an Insurance No Loss Letter Sample

An Insurance No Loss Letter is a document issued by an insurance company to confirm that the insured party has not incurred any losses during a specified period of time. This letter is often required when applying for loans, renewing contracts, or entering into new agreements to demonstrate the financial stability of the insured party.

Why do you need an Insurance No Loss Letter?

- Provide proof of financial stability

- Meet requirements for loans or contracts

- Assure business partners or clients of your reliability

Dear [Recipient’s Name],

I am writing to confirm that [Insured Party Name] has not incurred any losses covered by our insurance policy during the period of [Start Date] to [End Date]. As per our records, there have been no claims filed, and no payouts have been made during this time.

This Insurance No Loss Letter is being issued at the request of [Reason for Request], and we are happy to provide this confirmation of [Insured Party Name]’s financial stability.

If you require any further information or documentation, please do not hesitate to contact us at [Contact Information].

Sincerely,

[Your Name]

[Your Title]

Insurance No Loss Letter Sample

9 Best Images of Loss Of Coverage Letter Template – Patient Follow-Up

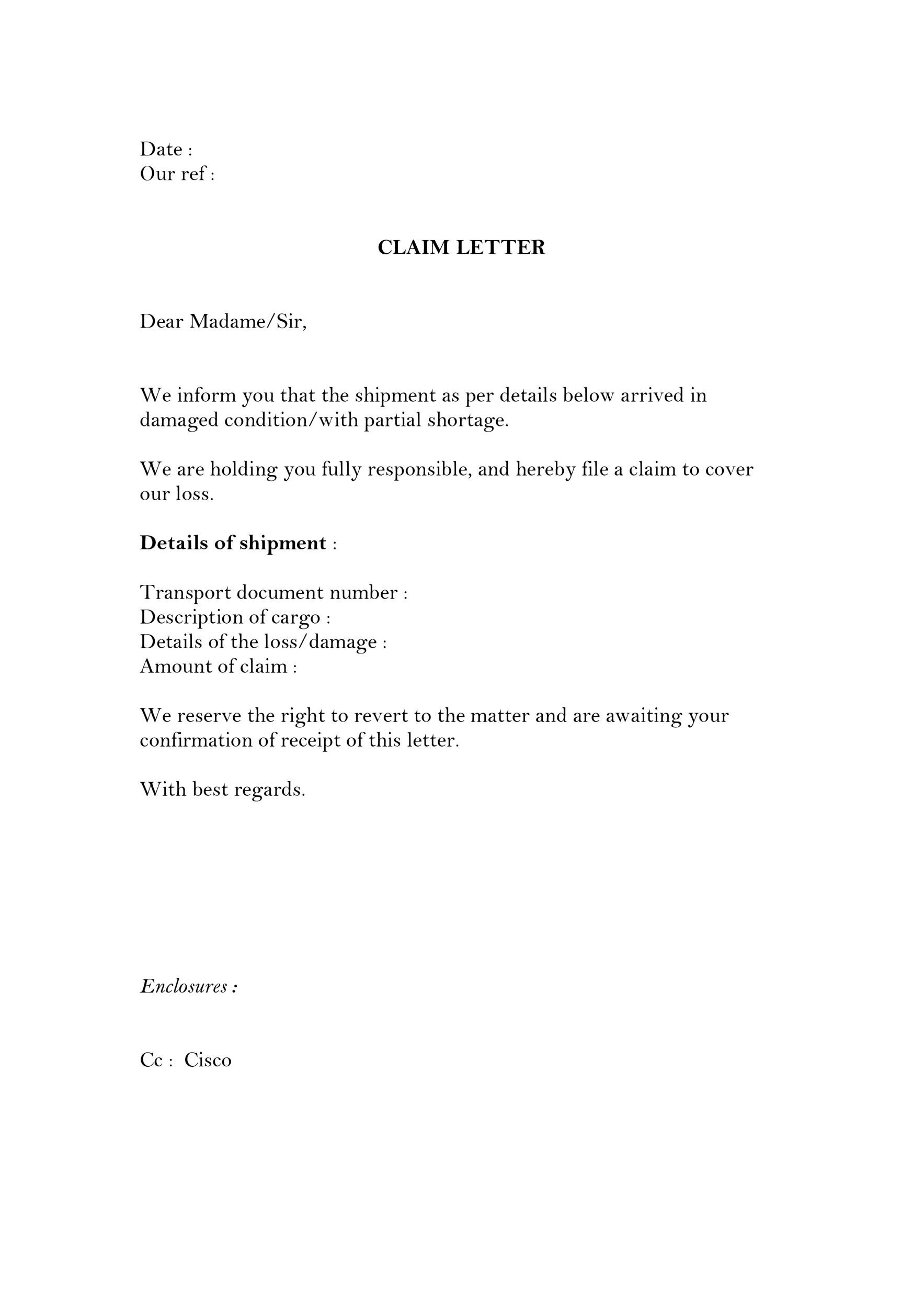

49 Free Claim Letter Examples – How to Write a Claim Letter?

49 Free Claim Letter Examples – How to Write a Claim Letter?

Fillable Statement Of No Loss Form – Printable Forms Free Online

FREE 5+ Insurance Termination Letters in PDF | MS Word

FREE 5+ Insurance Termination Letters in PDF | MS Word